child tax credit december 2021 how much will i get

From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17. For 2021 eligible parents or guardians.

Safeguarding Tax Credit Of Every Tax Form 26as Tax2win Online Taxes Filing Taxes Income Tax

If you did not receive the stimulus for a.

. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to. How much is the child tax credit worth. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Your newborn should be eligible for the Child Tax credit of 3600. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021.

How much will I receive in 2022. Heres what to expect from the IRS in 2022. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

These updated FAQs were released to the public in Fact Sheet. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic D. However the deadline to apply for the child tax credit payment passed on November.

The payment for children. FootballAll MoneyNewsPropertyShoppingTipsCloseMoneyNews MoneyHELP THE WAY Child tax credit 2022 How much and when will get David BoroffAlice GrahnsAnthony RussoKarina. Child Tax Credit 2022.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000. 2021 Updated on December 14. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. To be eligible for the.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child. Eligible families have received. The payments which could total as much as 300 for each child under age 6 and 250 for each one ages 6 to 17 will continue each month through December.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The other half of. Your newborn child is eligible for the the third stimulus of 1400.

If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and. M illions of families are worried about the child tax credit as the last advance payment for 2021 was made last December 15 and the big question is whether there will be. The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec.

How Next Years Credit Could Be Different. Your amount changes based on the age of your children. Last year eligible families began receiving monthly cash checks for 250 to 300 per child starting in July of 2021 as part of the expanded and reimagined Child Tax Credit.

However a child born or added to your family such as through adoption in 2021 can be a qualifying child for the full 2021 Child Tax Credit even if you did not receive monthly Child Tax. A childs age determines the amount. If you failed to use it in time you unfortunately missed.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Child Tax Credit 2021. The credit will be fully.

Tesla Tax Credit Coming To End On December 31st Act Fast To Save 1875 Tesla Tax Credits Cars Movie

Parents Guide To The Child Tax Credit Nextadvisor With Time

Itf 12c Pdf Expense Taxes Word Doc Taxact Self Assessment

Daily Banking Awareness 20 21 And 22 December 2020 Awareness Banking Financial

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

2021 Child Tax Credit Advanced Payment Option Tas

Latest News Chartered Accountant Equity Accounting

What Families Need To Know About The Ctc In 2022 Clasp

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2021 Tax Numbers Tax Return

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

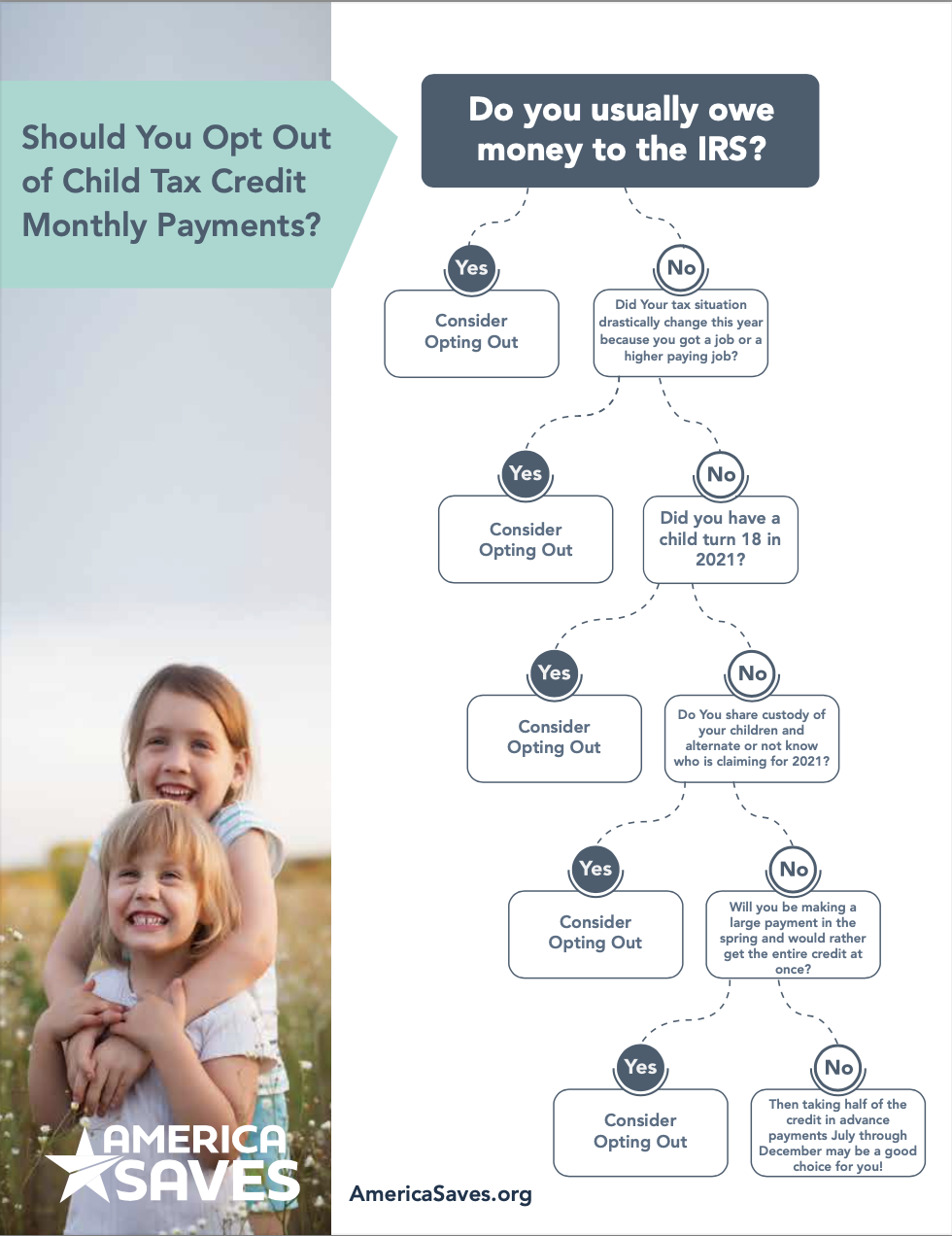

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet